Electric Off-Highway Equipment Industry | Forecast 2030

Grand View Research’s Electric Off-Highway Equipment industry databook is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The electric off-highway equipment market is poised to experience growth owing to factors such as urbanization, higher carbon, and electrification equipment driving the market growth. The electrification of agriculture equipment such as tractors, threshers, and ergonomic tools for increasing crop production while decreasing the overall cost drives market growth. The higher concentration of carbon emission by the construction industry is prompting the electrification of construction equipment vehicles such as excavators, motor graders, and loaders by replacing fossil fuel with batteries, which is further augmenting the market growth. Furthermore, incumbents in the mining industry are focusing on launching electric variants of equipment such as large dozers, mining trucks, crushers, and rotary drill rigs, contributing to the market growth.

Access the Global Electric Off-Highway Equipment Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies

Electric Agriculture Equipment Market Insights

Growing innovation in an attempt to electrify agricultural operations owing to rising carbon emission levels coupled with rising fuel prices is a major factor propelling the electric tractor market growth. The increasing concentration of commercial farming in regions of Asia, such as China and India, is further expected to support the demand for E-agriculture tractors. E- tractors carry certain advantages against their conventional counterparts, such as lesser sounds, economic feasibility, lower maintenance, longer product life, and compact designs are helping electric agricultural tractors gain traction within the farming and food & beverage industry.

Additionally, the technical advantages of electric agricultural tractors, such as lighter weight, lesser components, and increased productivity due to less fuel consumption make them a more economical choice for farmers. This advantage has the potential to position electric tractors as a preferable choice among farmers

The incumbents are leveraging technologies such as Artificial Intelligence, fleet management, data analytics, and autonomous vehicle principles for cost-effective and sustainable farming operations. For instance, in November 2022, Monarch Tractors announced the development of autonomous E-tractors calming to save 53 metric tons of carbon dioxide and USD 18 thousand per tractor. While addressing the growing shortage of farm labour, Monarch Tractors enables a single tractor operator to manage eight fleets of the electric tractor. The tractors are equipped with sensors and cameras for precise farm mapping while ensuring vehicle safety through real-time pitch management.

Order your copy of the Free Sample of “Electric Off-Highway Equipment Industry Data Book - Electric Agriculture Equipment, Construction Equipment, Mining Equipment Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Electric Construction Equipment Market Insights

OEMs such as Volvo and Hyundai are also developing and testing heavy equipment machinery. Recently, Hyundai Construction Equipment has partnered with Hyundai Motor Group to create construction equipment driven by the hydrogen fuel cells. Hyundai Construction Equipment will design, manufacture, and assess the performance of excavators and forklifts. At the same time, Hyundai Motors and Hyundai Mobis will develop and produce hydrogen fuel cell systems, including power packs. 2023 has been chosen as the deadline for widespread production and distribution.

Similarly, an articulated dump truck equipped with a fuel cell system is currently being tested by Volvo Construction Equipment (Volvo CE). The Volvo HX04 prototype was created as a result of a Swedish research effort. The heavy-duty hydrogen fuel cell vehicle is the outcome of a research project supported between 2018 and 2022 by various Swedish authorities.

OEMs in this market are actively developing and launching electric and low-noise construction equipment. For instance, At the 11th International Construction Equipment and Construction Technology Trade Fair, CII EXCON 2021, CASE Construction Equipment, a brand of CNH Industrial, displayed its new product line. The 770 NXe 49.5hp Loader Backhoe was the company's first piece of new machinery, followed by the 770 EX Plus, 851 FX CP version 845C Motor Grader, 1107EX Soil Vibratory Compactor, and CX220C LC-HD Excavator. Similarly, The JCB 19C-1E, the first fully electric excavator in the market, was unveiled by JCB India at Excon. On the NXT Platform, a 22 Ton Hydraulic Excavator created specifically for Indian applications was also introduced. In addition, a 4 Ton Telescopic Hander, AJ48 D Articulated Boom Lift, and the 35Z HD and 37C HD Mini Excavators for Smart Infrastructure were unveiled.

Go through the table of content of Electric Off-Highway Equipment Industry Data Book to get a better understanding of the Coverage & Scope of the study

Electric Mining Equipment Market Insights

This offers many benefits, such as reduced noise due to the absence of engines and limited greenhouse gas emissions. Electric mining equipment help in reducing heat in underground mine by increasing ventilation and cooling in the underground mining environment. The ongoing urbanization and industrialization are fueling the demand for natural resources such as oil and minerals. As a result, the global mining industry is flourishing. This, in turn, is expected to boost the demand for electric mining equipment, thereby leading to the growth of the market for this equipment worldwide. Companies operating in the mining equipment market are enhancing their product portfolio by including electric equipment in the lineup to meet the demand for various types of electric mining equipment, such as mineral processing equipment, crushers, surface mining tools, screening equipment, and mining drills & breakers. A range of variants that are either rechargeable batteries, cable-tethered, or use overhead trolley lines make up the most electrified mining equipment. The latter are more common in open-pit mines where using big surface trucks is necessary.

The continuously growing global population has surged the requirement for increased industrial activities and infrastructure development projects. In countries with high mining concentration, several nations with the most mining equipment, including China, Russia, Indonesia, South Africa, Australia, the USA, Canada, and Chile, may provide considerable investment opportunities for supporting the uptake of electric mining equipment in their respective regions A range of variants that are either rechargeable batteries, cable-tethered, or use overhead trolley-lines make up most electrified mining equipment. The latter are more common in open-pit mines where using big surface trucks is necessary.

Competitive Landscape

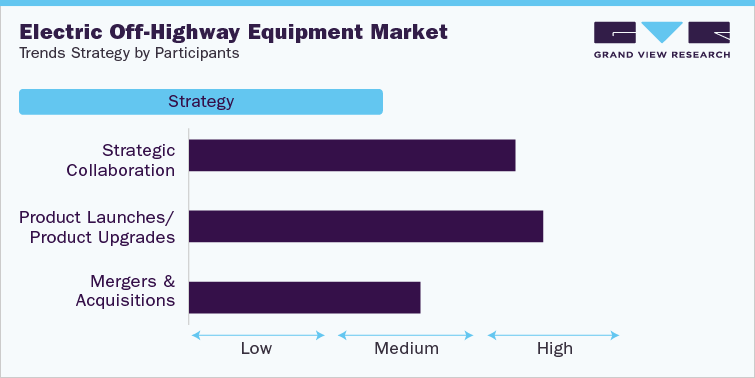

The market is competitive with the presence of major players Komatsu Ltd, Caterpillar Inc MaterMacc S.p.A, AGCO Corp., CLAAS KGaAmbH, Mahindra & Mahindra Ltd., SDF S.p.A., J C Bamford Excavators Ltd among others. These companies maintain an exhaustive product portfolio and are developing product lines up for electric tractors, mining equipment, and agricultural equipment. Additionally, the Companies are adopting several growth strategies, such as partnerships, mergers & acquisitions, and product launches, to stay afloat in the competitive industry.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list